| Platform | Best fit for | Starting Price | Free Trial | Demo | Use Cases |

|---|---|---|---|---|---|

| Freelancers, solopreneurs, and small businesses | Free | Yes | ||

| Freelancers, solopreneurs, and small businesses | Free | Yes | ||

| Freelancers, small to medium-sized businesses, and enterprises | €17.5 | Yes | ||

| Freelancers, consultants, and small service-based businesses | $15 | |||

| Freelancers, contractors, and small business owners | $4.99 | Yes |

4.2 out of 5

Product description

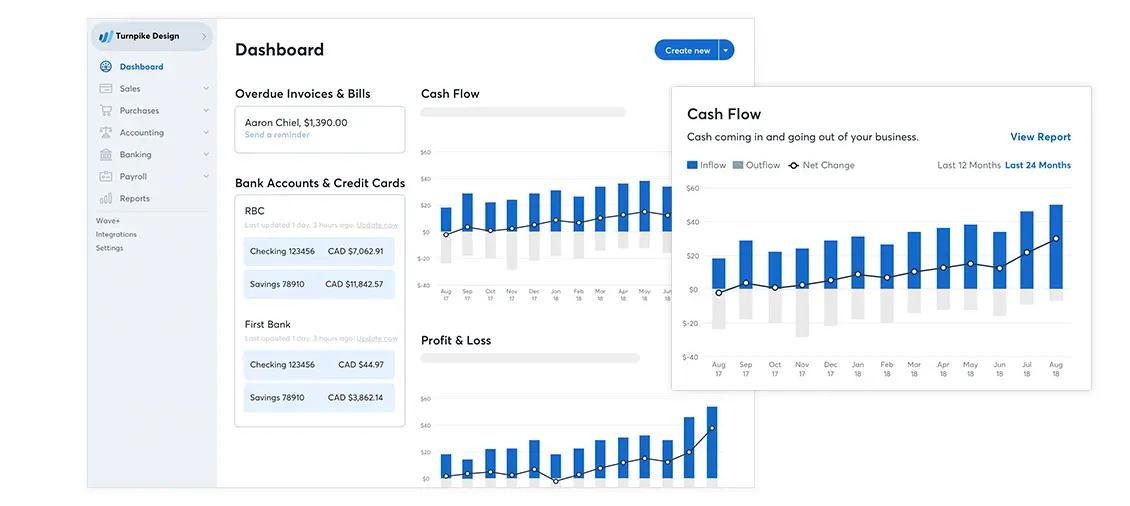

Wave Accounting is a cloud-based financial management platform tailored for freelancers, solopreneurs, and small businesses. It offers a suite of tools including invoicing, expense tracking, receipt scanning, and basic financial reporting—all accessible through a user-friendly interface. Wave’s core accounting and invoicing features are available for free, making it an attractive option for businesses seeking cost-effective solutions.

Our take

Product images

4.1 out of 5

Product description

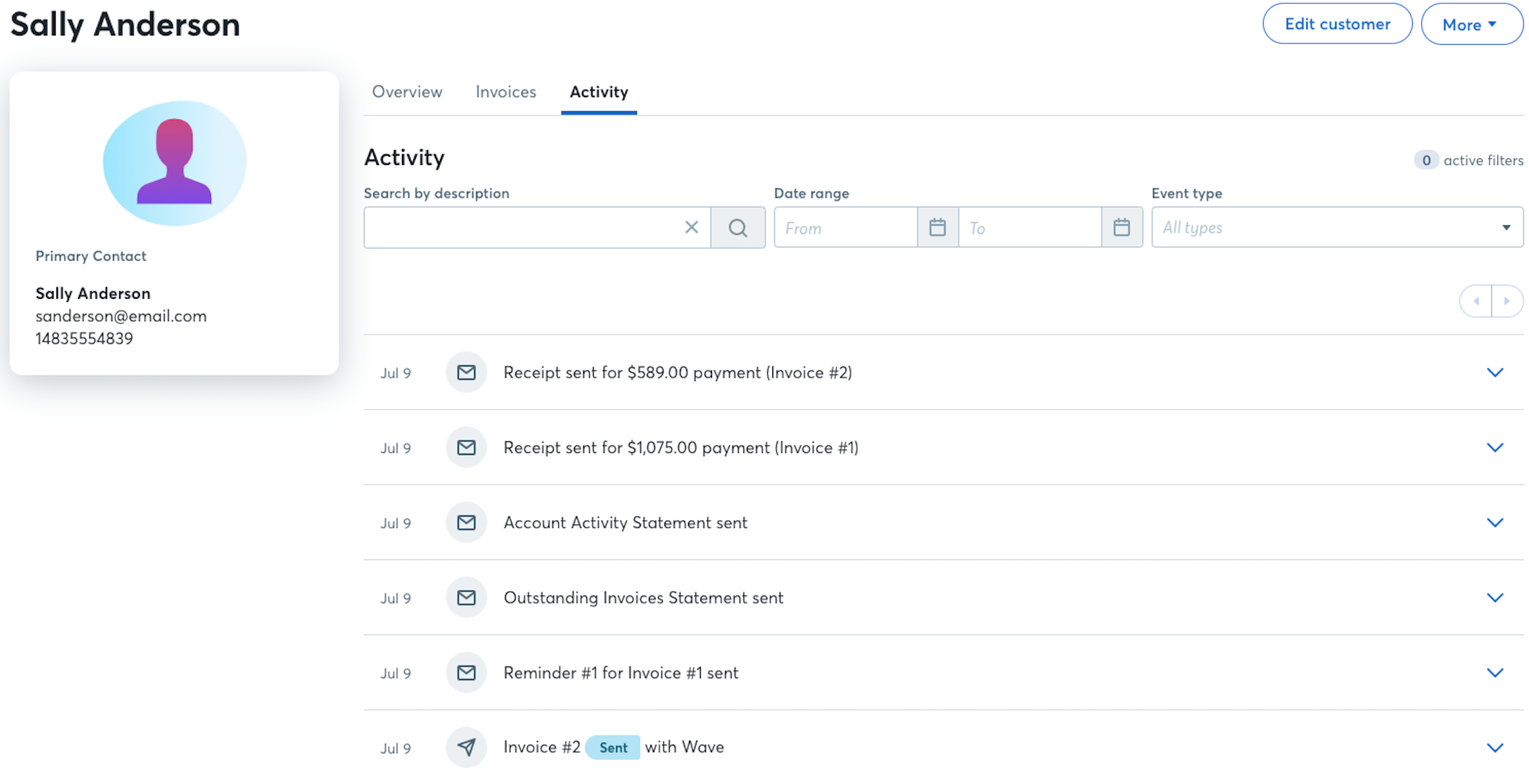

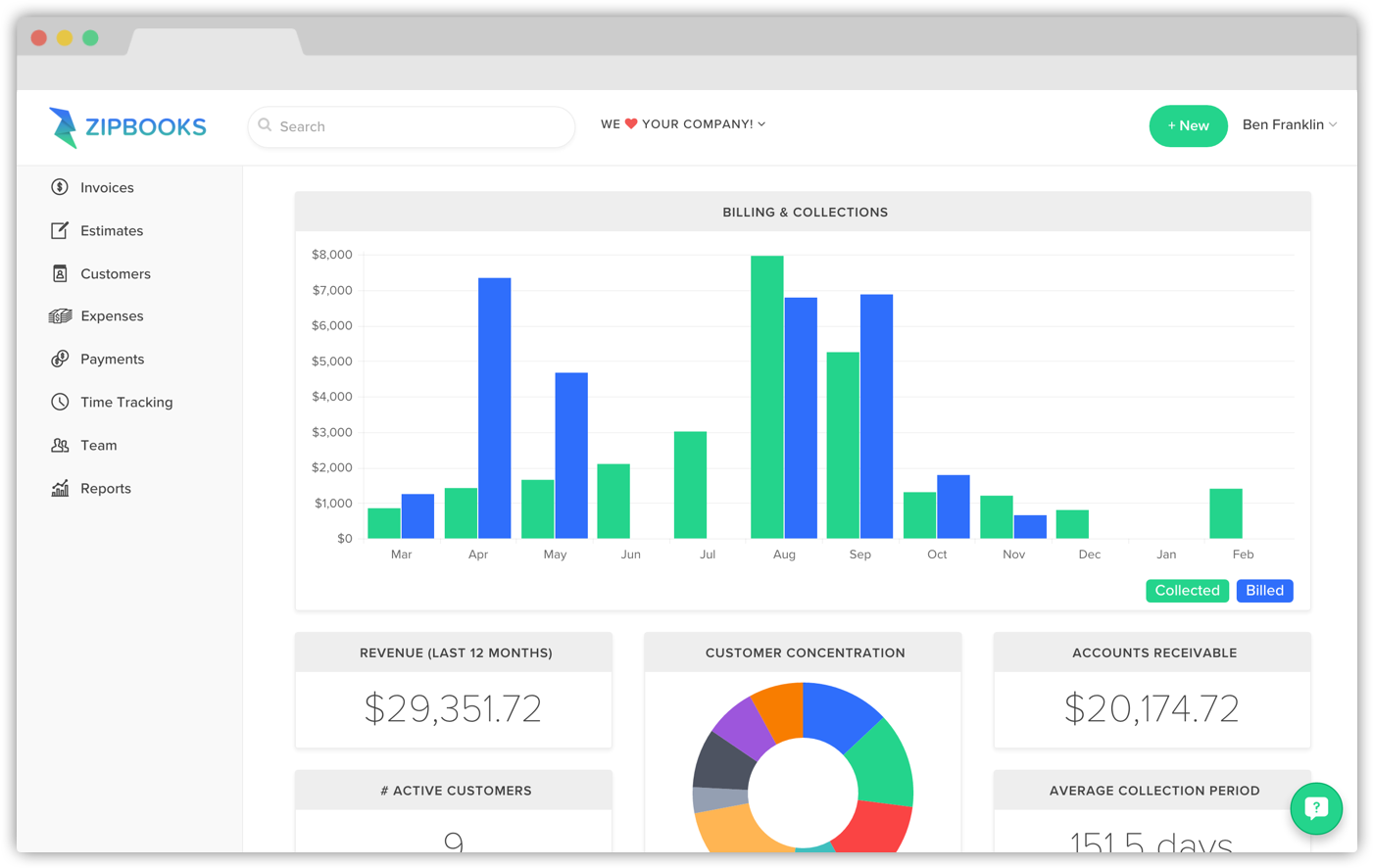

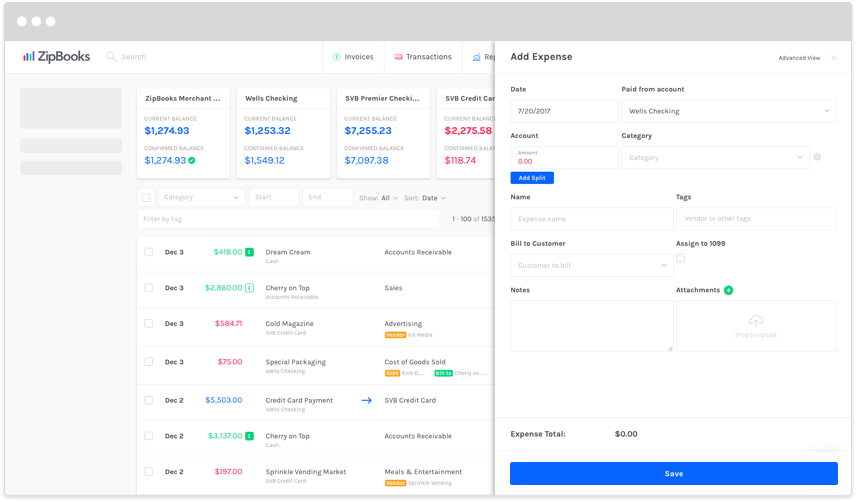

ZipBooks is a cloud-based accounting software designed for freelancers, small businesses, and startups seeking a streamlined financial management solution. It offers features such as invoicing, expense tracking, time tracking, bank reconciliation, and financial reporting. With its intuitive interface and automation capabilities, ZipBooks simplifies bookkeeping tasks, allowing users to focus on growing their business.

Our take

Product images

4 out of 5

Product description

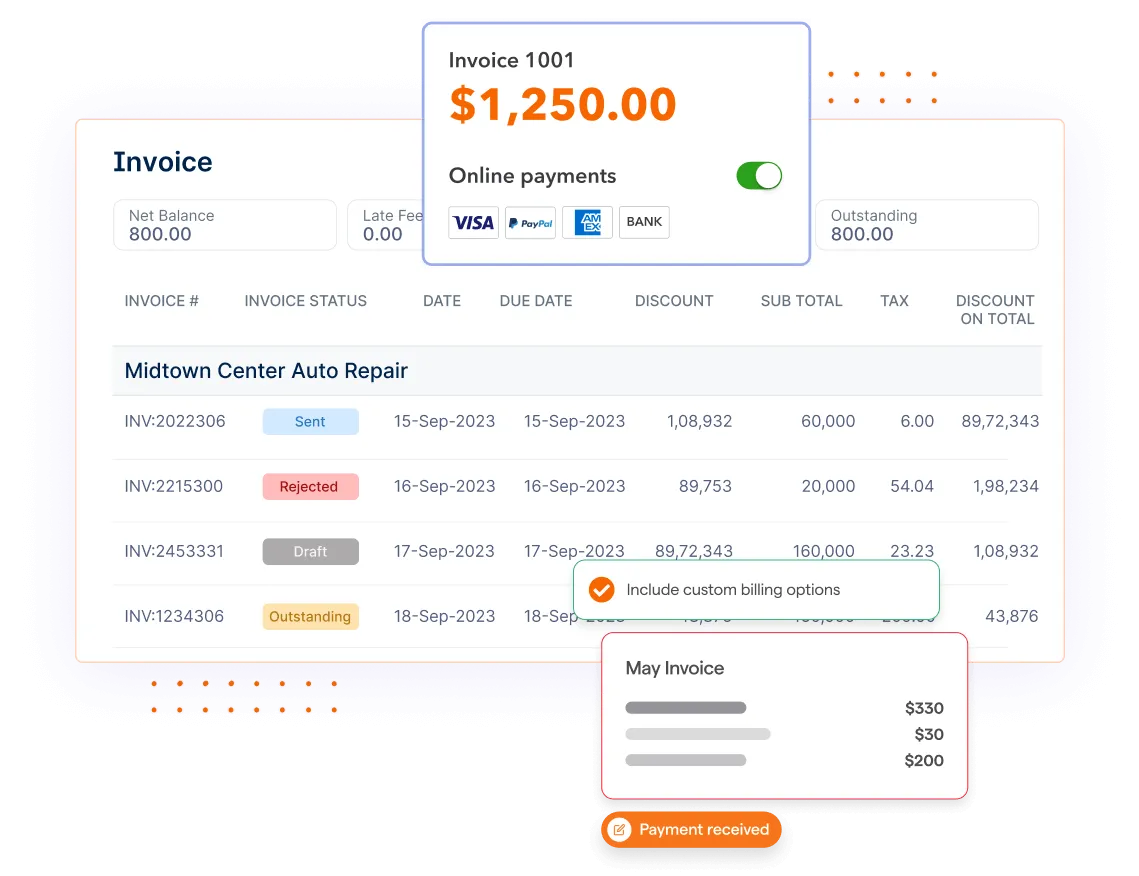

Invoicera is a cloud-based invoicing and billing software designed to streamline financial operations for businesses of all sizes. It offers features such as automated invoicing, expense management, time tracking, and multi-currency support. With customizable templates and integration capabilities, Invoicera aims to enhance efficiency and accuracy in billing processes.

Our take

Product images

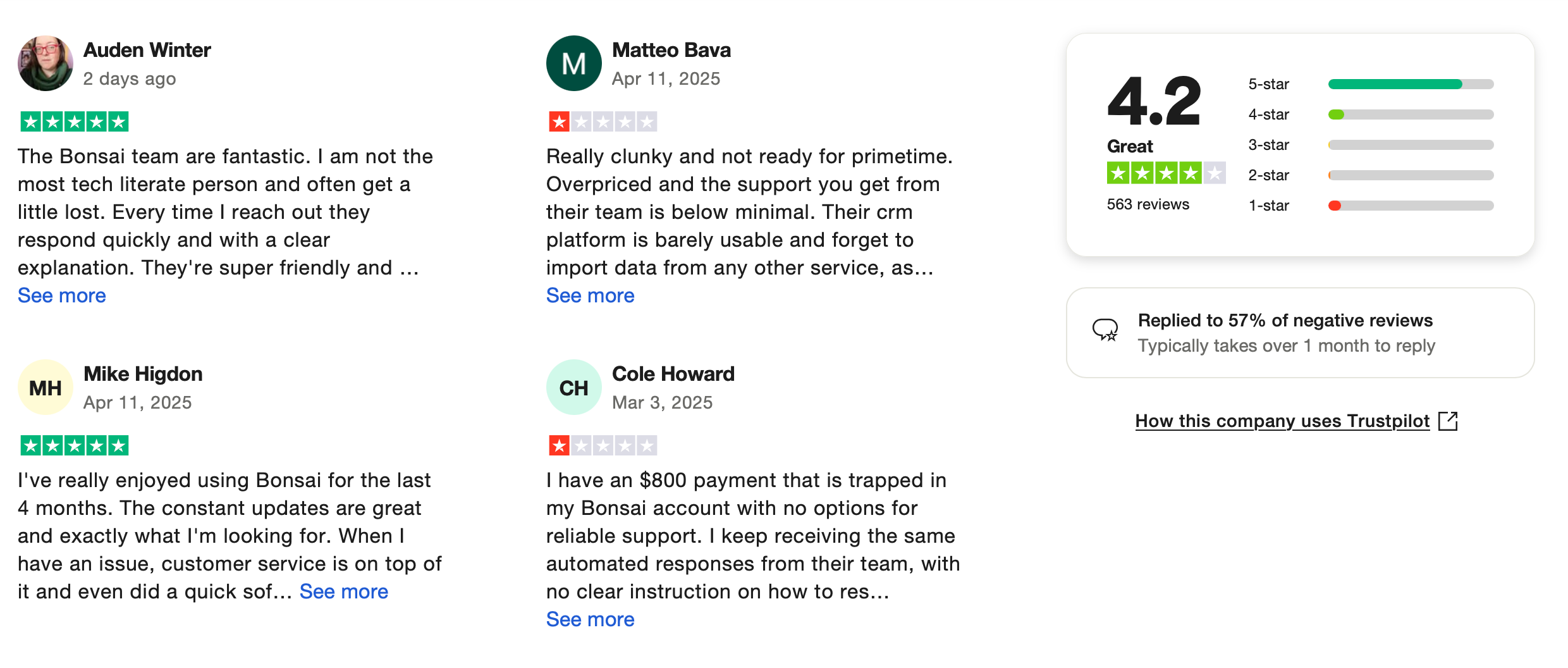

4.2 out of 5

Product description

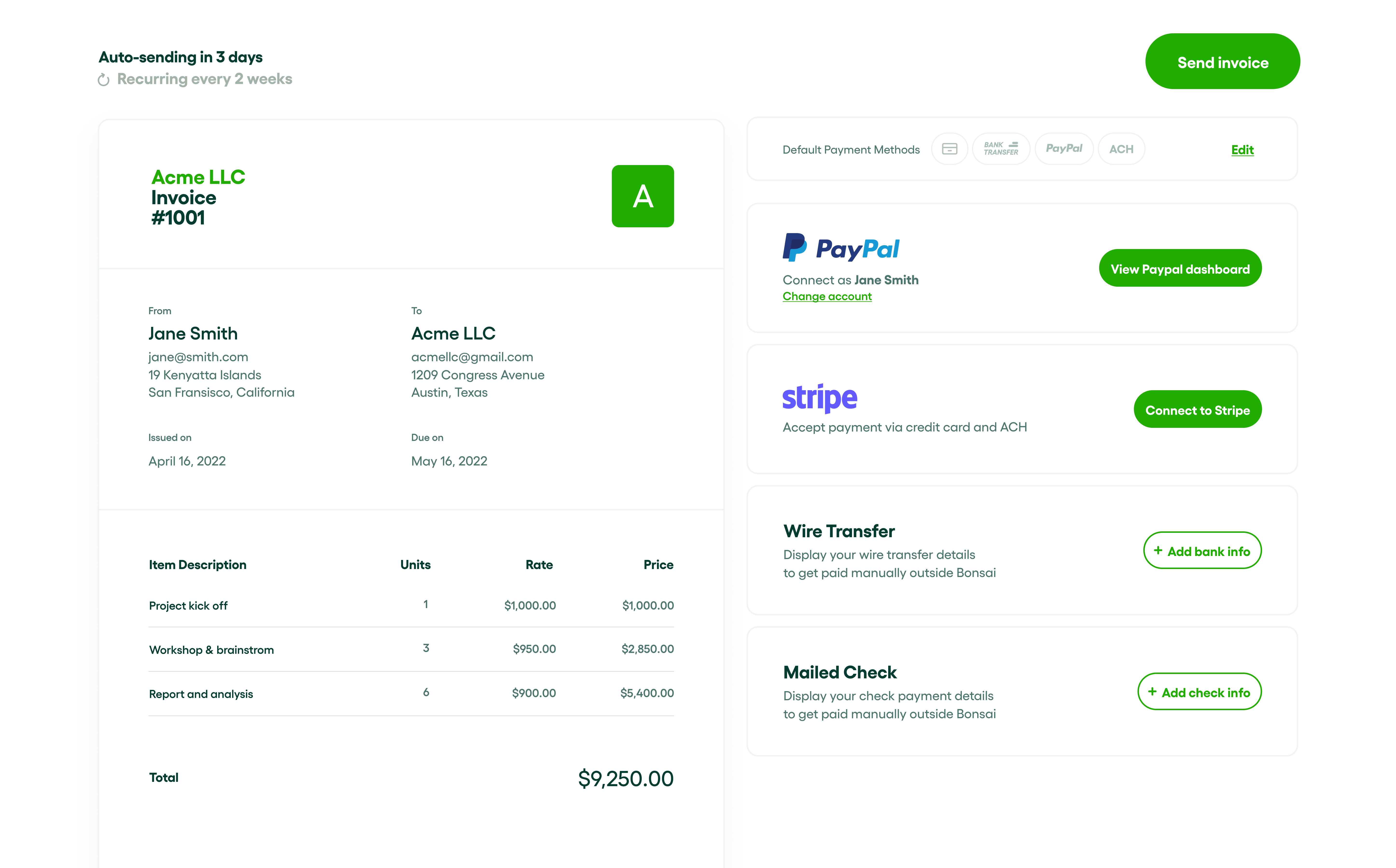

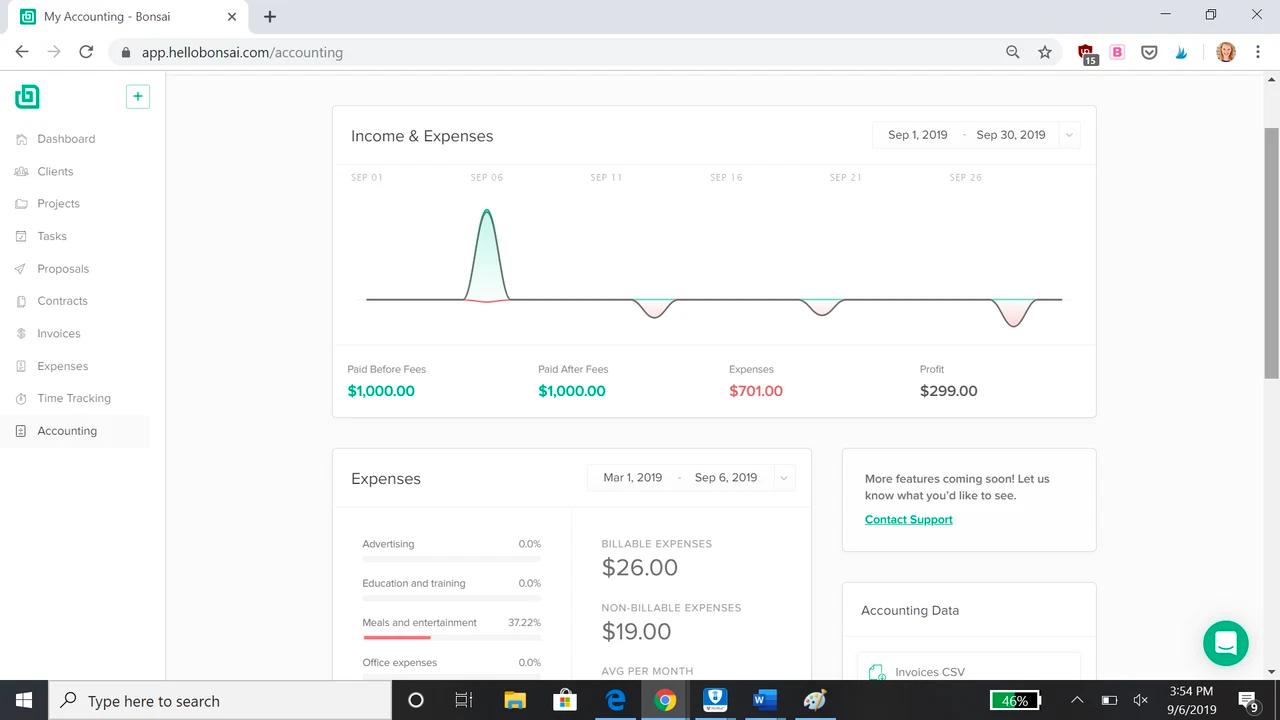

Hello Bonsai is an all-in-one business management platform tailored for freelancers, solopreneurs, and small service-based businesses. It offers a comprehensive suite of tools, including proposals, contracts, time tracking, invoicing, expense tracking, and tax management. With its intuitive interface and automation capabilities, Bonsai streamlines administrative tasks, allowing users to focus on their core work.

Our take

Product images

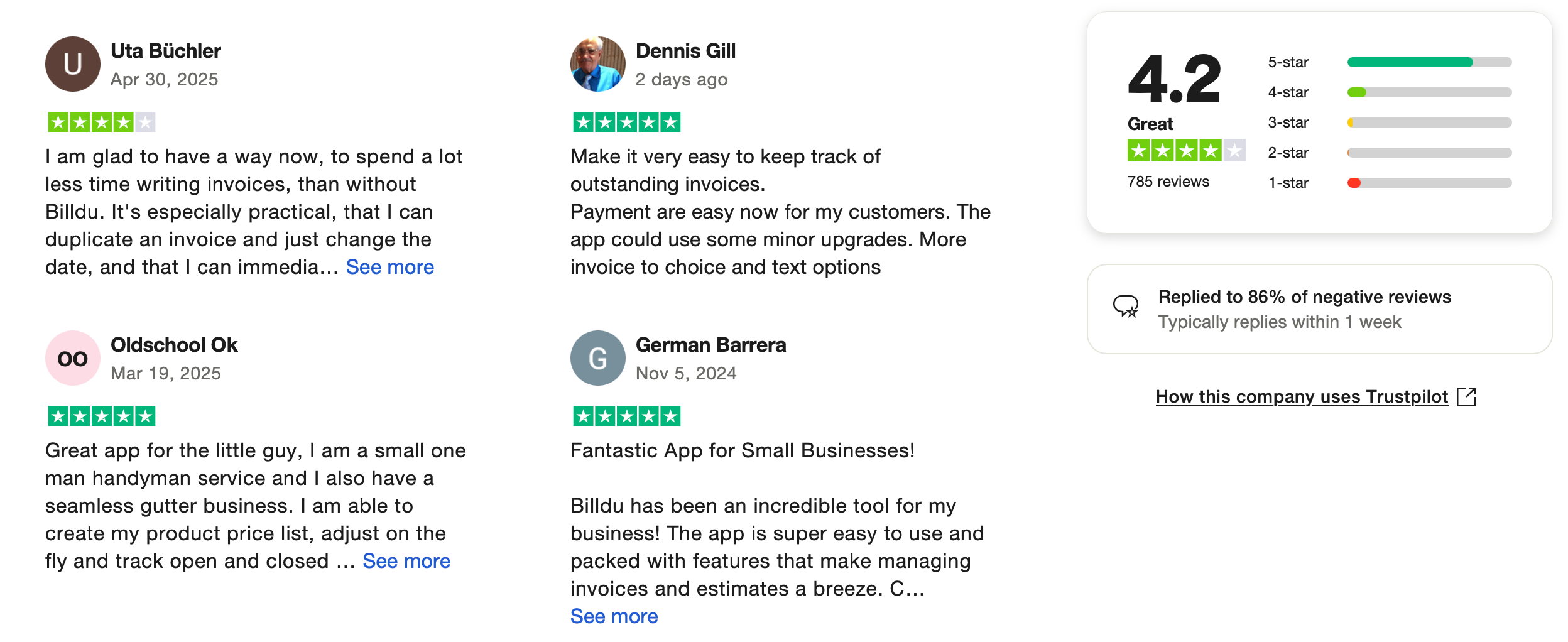

4.2 out of 5

Product description

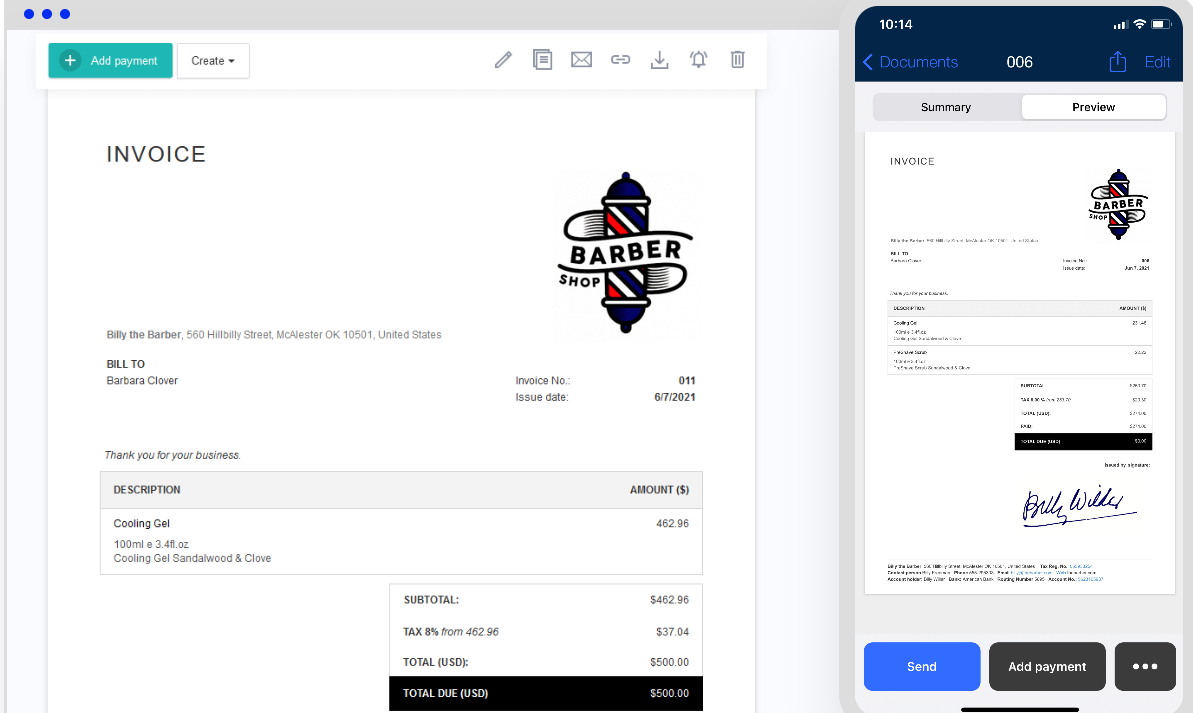

Billdu is a cloud-based invoicing and billing software designed for freelancers, small businesses, and contractors. It offers features such as invoice creation, expense tracking, online payments, and automated reminders. With its mobile-friendly design, Billdu enables users to manage their billing processes on the go.

Our take

Product images

Want to learn more about how Social Cat is better?Start free trial and connect with influencers. Let's discuss your UGC video needs and how we can meet them!

FAQS

Some of the most asked questions about the accounting tools

1. What is an accounting tool?

An accounting tool is software designed to help individuals or businesses manage financial activities like invoicing, expense tracking, payroll, tax reporting, and financial reporting, all in one place.

2. Why should I use accounting software instead of spreadsheets?

Accounting software automates calculations, reduces errors, saves time, and often includes features like tax preparation, bank syncing, and real-time reporting, things spreadsheets don’t handle as efficiently.

3. Are there free accounting tools available?

Yes, some tools like Wave and Zoho Books offer free plans with basic features suited for freelancers or small businesses. These plans usually include invoicing, expense tracking, and basic reporting.

4. What features should I look for in an accounting tool?

Important features include invoicing, expense tracking, bank reconciliation, tax calculation, financial reports, payroll support, and integrations with other tools like payment gateways or CRMs.

5. Can I use accounting tools if I’m not an accountant?

Absolutely. Most tools are built with non-accountants in mind, offering user-friendly dashboards, automation, and simple explanations to help you manage finances without needing professional training.

6. Do accounting tools help with tax preparation?

Yes. Many tools can calculate tax automatically, generate tax reports, and even integrate with tax filing services or your accountant to simplify the tax preparation process.

7. Can these tools track income and expenses automatically?

Yes. Many accounting tools let you connect your bank accounts and credit cards to automatically import and categorize income and expenses, saving you manual entry time.

8. Are accounting tools safe to use for financial data?

Reputable accounting tools use encryption, secure servers, and multi-factor authentication to protect your financial data. Always choose a trusted provider with strong security measures in place.

9. What’s the best accounting tool for small businesses?

Tools like QuickBooks, FreshBooks, and Xero are popular choices for small businesses due to their balance of features, usability, and scalability. The best one depends on your specific needs and budget.

10. Can I generate reports like profit and loss or cash flow statements?

Yes. Most accounting tools come with built-in reporting features to generate profit and loss statements, balance sheets, cash flow summaries, and other key financial reports to help you monitor your business.